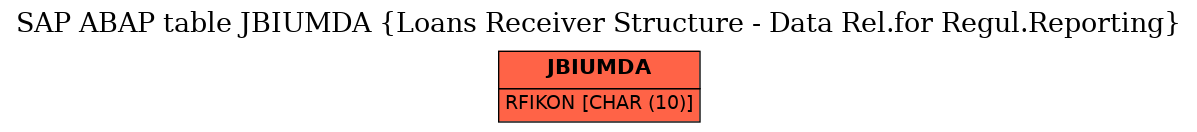

SAP ABAP Table JBIUMDA (Loans Receiver Structure - Data Rel.for Regul.Reporting)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B (Application Component) Bank Components

IS-B (Application Component) Bank Components

⤷ JBS (Package) Application development IS-B Statutory Reporting

JBS (Package) Application development IS-B Statutory Reporting

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBIUMDA |

|

| Short Description | Loans Receiver Structure - Data Rel.for Regul.Reporting |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 2 | |

RANL | RANL | CHAR | 13 | 0 | Contract Number | ||

| 3 | |

SARCHIV | SARCHIV | CHAR | 1 | 0 | Archiving Category Indicator | ||

| 4 | |

RANLALT1 | CHAR13 | CHAR | 13 | 0 | Alternative Identification | ||

| 5 | |

JBOBJNR | J_OBJNR | CHAR | 22 | 0 | Object number for financial transactions | * | |

| 6 | |

JBSMODE | JBSMODE | CHAR | 1 | 0 | Mode of Data Flow | ||

| 7 | |

0 | 0 | Loans Table for Regulatory Reporting (INCLUDE Structure) | |||||

| 8 | |

JBBAKAKN | WERTV9 | CURR | 17 | 2 | Syndicate Share of the Lender | ||

| 9 | |

JBBNACHH | WERTV9 | CURR | 17 | 2 | Risk Amount for Underwriting Bank with Pass-Through Security | ||

| 10 | |

JBBVORHA | WERTV9 | CURR | 17 | 2 | Risk Amount for Suggested CI with Pass-Through Loans | ||

| 11 | |

JBSABTRT | JBSABTRT | CHAR | 1 | 0 | Indicator - Assignment of Loan Receivables for Collateral | * | |

| 12 | |

JBSBUEKZ | JBSBUEKZ | CHAR | 1 | 0 | Indicator - Guarantee / $ 14 GAB Double Display | * | |

| 13 | |

JBJWOBAU | JBJWOBAU | CHAR | 1 | 0 | Indicator - Loans for House-Building | * | |

| 14 | |

JBSFOART | JBSFOART | CHAR | 2 | 0 | Subdivision for Various Asset-Side Items | * | |

| 15 | |

JBSHYPKR | JBSHYPKR | CHAR | 1 | 0 | Mortgage Loans | * | |

| 16 | |

STILGART | STILGART | NUMC | 1 | 0 | Repayment Type Indicator | ||

| 17 | |

JBBEWBRE | WERTV9 | CURR | 17 | 2 | Individual Value Adjustment Surplus Amount | ||

| 18 | |

JBBRLZ1J | WERTV9 | CURR | 17 | 2 | Loan Parts w.Resid.Term of Upto 1 Year to For.Parties in DM | ||

| 19 | |

JBBRLZ2J | WERTV9 | CURR | 17 | 2 | Loan Parts w.Resid.Term of 1 Year Plus to For.Parties in DM | ||

| 20 | |

JBBWTFSL | WERTV9 | CURR | 17 | 2 | Special Balance Receivables Due Daily | ||

| 21 | |

JBBWTVSL | WERTV9 | CURR | 17 | 2 | Special Balance Payables Due Daily | ||

| 22 | |

JBRKNSFH | CHAR010 | CHAR | 10 | 0 | Syndicate Leader | ||

| 23 | |

JBSGEMKR | JBSGEMKR | CHAR | 2 | 0 | Indicator - Joint Loan | * | |

| 24 | |

JBSTRHND | JBSTRHND | CHAR | 1 | 0 | Indicator for Trust Assets | * | |

| 25 | |

JBSZUSKC | JBSZUSKC | CHAR | 1 | 0 | Indicator - Irrevocable Loan Commitment | ||

| 26 | |

JBBKKOST | PRZ33V | DEC | 6 | 3 | Credit Costs Effective p.a. (§13 Display) | ||

| 27 | |

JBBMIOSI | WERTV9 | CURR | 17 | 2 | Secured Amount in Millions | ||

| 28 | |

JBBORGSI | WERTV9 | CURR | 17 | 2 | Secured Staff Loan | ||

| 29 | |

JBBRUECK | WERTV9 | CURR | 17 | 2 | Separate Display of Arrears with Display in Millions | ||

| 30 | |

JBSSICHA | JBSSICHA | CHAR | 2 | 0 | Type of Loan Collateral - § 14 /16 | * | |

| 31 | |

JBPTILGS | PRZ33V | DEC | 6 | 3 | Repayment Rate According to § 16 | ||

| 32 | |

JBSVERWZ | JBSVERWZ | CHAR | 3 | 0 | Intended Use of Loan | ||

| 33 | |

JBSVRBRT | JBSVRBRT | CHAR | 2 | 0 | Subdivision for Various Liabilities-Side Items | * | |

| 34 | |

JBBZUSGA | WERTV9 | CURR | 17 | 2 | Amount Open Commitment for Foreign Loan Portfolio | ||

| 35 | |

JBBZUSGC | WERTV9 | CURR | 17 | 2 | Amount Open Commitments for COOKE | ||

| 36 | |

JBDZUSEN | DATUM | DATS | 8 | 0 | Expiry Date of External Loan Commitment | ||

| 37 | |

JBBAVALD | WERTV9 | CURR | 17 | 2 | Amount of Guarantee | ||

| 38 | |

JBBEWBER | WERTV9 | CURR | 17 | 2 | Individual Value Adjustments | ||

| 39 | |

JBBGSIKO | WERTV9 | CURR | 17 | 2 | Correction Value for Principle I Balance | ||

| 40 | |

JBBKOMP1 | WERTV9 | CURR | 17 | 2 | Netting Amount | ||

| 41 | |

JBBKOMP2 | WERTV9 | CURR | 17 | 2 | Compensation Amount 2 | ||

| 42 | |

JBBMBMSL | WERTV9 | CURR | 17 | 2 | Amount for Market Valuation Method | ||

| 43 | |

JBBUNEPG | WERTV9 | CURR | 17 | 2 | Simulated Repurchase Transaction | ||

| 44 | |

JBBUNTER | WERTV9 | CURR | 17 | 2 | Subparticipation | ||

| 45 | |

JBBWKTSL | WERTV9 | CURR | 17 | 2 | Balance in Original Currency | ||

| 46 | |

JBBZUSAG | WERTV9 | CURR | 17 | 2 | Amount Commitments (Commitment Statistics) | ||

| 47 | |

JBJZUSTA | JBJZUSTA | CHAR | 1 | 0 | Indicator for Commitment Statistics | * | |

| 48 | |

JBRFIKON | SAKNR | CHAR | 10 | 0 | Account Number of Bank's General Ledger Acount | * | |

| 49 | |

JBSAMRKZ | JBSAMRKZ | CHAR | 1 | 0 | MRD indicator | * | |

| 50 | |

JBSLKFIN | JBSLKFIN | CHAR | 1 | 0 | Locally-Funded Transactions | * | |

| 51 | |

JBSNRANG | JBSNRANG | CHAR | 1 | 0 | Indicator for Subordinated Receivables/Payables | * | |

| 52 | |

JBSZUSKZ | JBSZUSKZ | CHAR | 2 | 0 | External Loan Commitment | * | |

| 53 | |

JBBAUSBT | WERTV9 | CURR | 17 | 2 | Disbursement in Reporting Period | ||

| 54 | |

JBBMIOS2 | WERTV9 | CURR | 17 | 2 | Second Secured Amount in Millions | ||

| 55 | |

JBBSPBET | WERTV9 | CURR | 17 | 2 | Special Amount for Exempted Partial Balance | ||

| 56 | |

JBSAMRKR | JBSAMRKR | CHAR | 3 | 0 | MRD Adjustment Item | * | |

| 57 | |

JBSAMRSN | JBSAMRSN | CHAR | 1 | 0 | Other Reserve-Carrying Liabilities | * | |

| 58 | |

JBSANWKA | CHAR15 | CHAR | 15 | 0 | User-Specific Credit Type Text | ||

| 59 | |

JBSKRART | JBSKRART | CHAR | 2 | 0 | Credit Type Text | * | |

| 60 | |

JBSVRSIC | JBSVRSIC | CHAR | 2 | 0 | Payables Against Collateral | * | |

| 61 | |

JBSAMRFR | JBSAMRFR | CHAR | 1 | 0 | Exemptions According to Minimum Reserve Directive | * | |

| 62 | |

JBSAUFRE | JBSAUFRE | CHAR | 2 | 0 | Indicator - Account Netting Type | * | |

| 63 | |

JBSVRARB | JBSVRARB | CHAR | 2 | 0 | Processing Indicator | * | |

| 64 | |

JBSKREDT | JBSKREDT | CHAR | 2 | 0 | Credit Type for German Banking Act | * | |

| 65 | |

JBSIA1PN | JBSIA1PN | CHAR | 1 | 0 | Statistical Repurchase Agreements | * | |

| 66 | |

JBSABZUG | JBSABZUG | CHAR | 1 | 0 | Deduction of Liable Equity Capital | * | |

| 67 | |

JBBKLIM2 | WERTV9 | CURR | 17 | 2 | 2nd External Credit Commitment | ||

| 68 | |

JBBKLIMI | WERTV9 | CURR | 17 | 2 | Irreducible Credit Limit | ||

| 69 | |

JBBILIMT | WERTV9 | CURR | 17 | 2 | Internal Credit Limit | ||

| 70 | |

JBBDMGEG | WERTV9 | CURR | 17 | 2 | DM Equivalent |

History

History

| Last changed by/on | SAP | 20011002 |

| SAP Release Created in |