SAP ABAP Table PS0062 (HR master record Infotype 0062 (Tax - Spain))

Hierarchy

Hierarchy

☛

SAP_HRCES (Software Component) Sub component SAP_HRCES of SAP_HR

SAP_HRCES (Software Component) Sub component SAP_HRCES of SAP_HR

⤷ PA-PA-ES (Application Component) Spain

PA-PA-ES (Application Component) Spain

⤷ PB04 (Package) HR Master Data: Spain

PB04 (Package) HR Master Data: Spain

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0062 |

|

| Short Description | HR master record Infotype 0062 (Tax - Spain) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

CODIM | CHAR9 | CHAR | 9 | 0 | Tax payer's reference number (NIF) | ||

| 2 | |

CODAU | PB04_CODAU | NUMC | 2 | 0 | Tax modifier (employment tax) | ||

| 3 | |

FAMS1 | FAMST | CHAR | 1 | 0 | Marital status | * | |

| 4 | |

PES_NFAMI | DEC2 | DEC | 2 | 0 | Number of family members relevant for employment tax (IRPF) | ||

| 5 | |

SBRUT | WERTV5 | CURR | 9 | 2 | Gross salary | ||

| 6 | |

VESFI | WERTV5 | CURR | 9 | 2 | Fixed variable payments | ||

| 7 | |

VESVR | WERTV5 | CURR | 9 | 2 | Variable variable payments | ||

| 8 | |

PORAP | DEC2 | DEC | 2 | 0 | Percentage applied | ||

| 9 | |

CPERX | CPERX | CHAR | 1 | 0 | Payment key | T5EIA | |

| 10 | |

MOTIV | MOTIV | NUMC | 2 | 0 | Reason for markdown | T5E38 | |

| 11 | |

PES_CATMIN | PES_CATMIN | CHAR | 1 | 0 | Challenge category for fiscal purposes | ||

| 12 | |

PERT1 | CHAR9 | CHAR | 9 | 0 | Work permit number | ||

| 13 | |

CPER2 | CPER2 | NUMC | 1 | 0 | Payment subkey | ||

| 14 | |

PGEES | WERTV5 | CURR | 9 | 2 | Payment in kind for IRPF | ||

| 15 | |

PECOM | WERTV5 | CURR | 9 | 2 | Compensatory payments | ||

| 16 | |

PB04_QLAND | LAND1 | CHAR | 3 | 0 | Country code | * | |

| 17 | |

PES_RENIR | WERTV5 | CURR | 9 | 2 | Reduction due to irregular performances | ||

| 18 | |

PES_COTIZ | WERTV5 | CURR | 9 | 2 | Social insurance or healthcare company costs | ||

| 19 | |

PES_ALIME | WERTV5 | CURR | 9 | 2 | Annuities for child maintenance | ||

| 20 | |

PES_REGRT | WERTV5 | CURR | 9 | 2 | Employment tax (IRPF): Deductions up to adjustment | ||

| 21 | |

PES_REGBR | WERTV5 | CURR | 9 | 2 | Gross annual salary received | ||

| 22 | |

PES_PORAP | DEC2_2 | DEC | 4 | 2 | Employment tax (IRPF) code applied | ||

| 23 | |

PES_PROVN | REGIO | CHAR | 3 | 0 | Province | T005S | |

| 24 | |

PES_296CD | CHAR12 | CHAR | 12 | 0 | Foreign code | ||

| 25 | |

PES_PORDB | DEC2_2 | DEC | 4 | 2 | Employment tax code stored (database only not displayed) | ||

| 26 | |

PES_ENDDA | DATS | DATS | 8 | 0 | End date | ||

| 27 | |

PES_FNOIR | DATUM | DATS | 8 | 0 | Payroll date for adjustment amounts | ||

| 28 | |

PES_PORPR | DEC2_2 | DEC | 4 | 2 | Previous IRPF percentage | ||

| 29 | |

PES_PORAP | DEC2_2 | DEC | 4 | 2 | Employment tax (IRPF) code applied | ||

| 30 | |

PES_ART81 | PES_INDICADOR | CHAR | 1 | 0 | Apply Article 81.5 | ||

| 31 | |

PES_MOCON | PES_MOCON | CHAR | 1 | 0 | Contract type for tax according to the tax office | ||

| 32 | |

PES_PORNA | CHAR1 | CHAR | 1 | 0 | Payroll percentage maintained automatically | ||

| 33 | |

PES_SEXPA | PES_SEXPA | CHAR | 1 | 0 | Expatriate situation | ||

| 34 | |

PES_MIPAG | PES_MIPAG | CHAR | 1 | 0 | Decrease due to mortgage | ||

| 35 | |

PES_MINOP | WERT05 | CURR | 9 | 2 | Applied decrease | ||

| 36 | |

PES_RENI2 | WERTV5 | CURR | 9 | 2 | Reduction due to irregular performance | ||

| 37 | |

PES_SITPER | PES_SITPER | CHAR | 1 | 0 | Personal situation for employment tax | ||

| 38 | |

PES_WERTX | XFELD | CHAR | 1 | 0 | Reduction due to extentsion of work activity | ||

| 39 | |

0 | 0 |

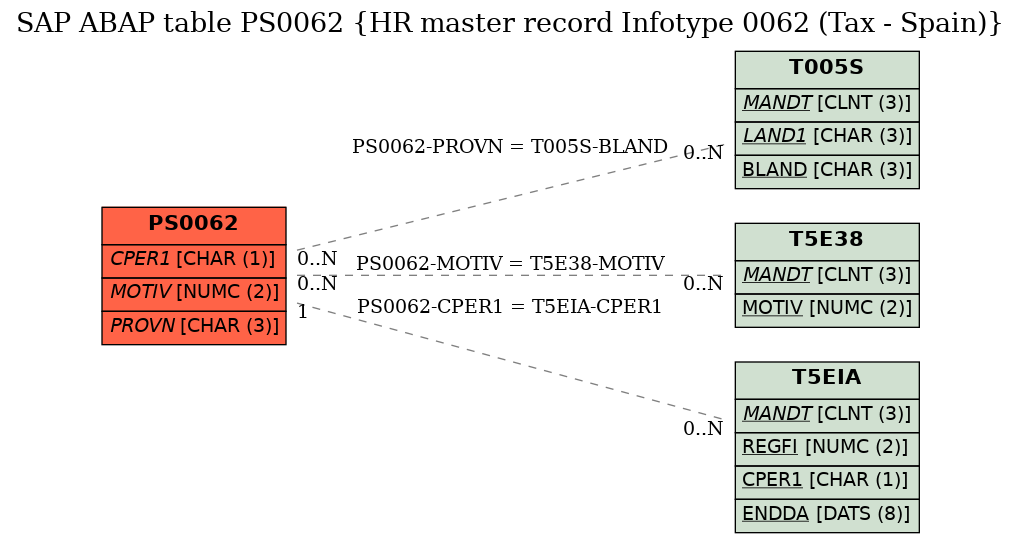

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PS0062 | CPER1 | |

|

REF | 1 | CN |

| 2 | PS0062 | MOTIV | |

|

|||

| 3 | PS0062 | PROVN | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |